Exploring the realm of Trip Insurance for Business Travelers: Corporate Coverage Options, this introductory piece sets the stage with a captivating narrative, engaging readers right from the start.

The subsequent paragraph delves into the specifics of the topic, providing a comprehensive overview that is both informative and intriguing.

Overview of Trip Insurance for Business Travelers

Business travel can be unpredictable, with various risks and uncertainties that can disrupt your plans and incur unexpected expenses. This is where trip insurance for business travelers plays a crucial role in providing financial protection and peace of mind during your corporate trips.

Key Benefits of Trip Insurance for Corporate Travelers

- Coverage for Trip Cancellation:Trip insurance can reimburse you for non-refundable expenses if your trip is canceled due to unforeseen circumstances such as illness or natural disasters.

- Emergency Medical Assistance:In case of a medical emergency during your business trip, trip insurance can cover medical expenses, hospital stays, and emergency evacuation.

- Travel Delay Compensation:If your flight is delayed or canceled, trip insurance can provide compensation for additional expenses such as accommodation and meals.

- Baggage Loss or Delay:Trip insurance can reimburse you for lost or delayed baggage, ensuring you have the essentials needed for your business meetings.

Risks Associated with Business Travel and How Trip Insurance Mitigates Them

- Flight Cancellations:Airlines can cancel flights due to various reasons, leaving you stranded. Trip insurance can help cover the costs of rebooking flights or finding alternative transportation.

- Medical Emergencies:Falling ill or getting injured during a business trip can result in high medical expenses. Trip insurance ensures you receive necessary medical care without worrying about the costs.

- Lost or Delayed Baggage:Losing your luggage or having it delayed can disrupt your business plans. Trip insurance provides compensation for essential items needed for your trip.

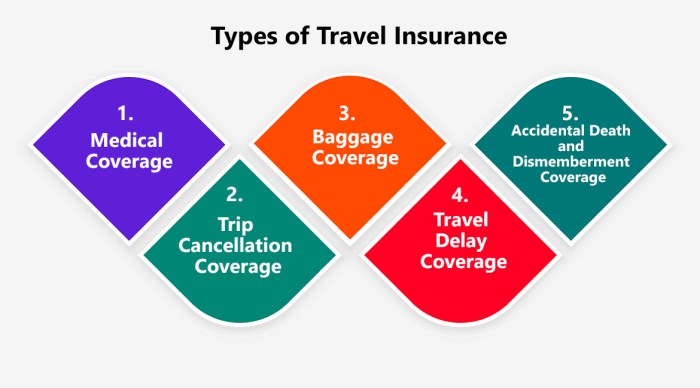

Types of Coverage Options Available

When it comes to trip insurance for business travelers, there are various coverage options available to cater to their specific needs and concerns. From basic coverage to comprehensive plans, business travelers have a range of choices to ensure they are protected during their corporate trips.

Basic Coverage vs. Comprehensive Coverage

Basic coverage typically includes essential benefits such as trip cancellation, trip interruption, and travel delay coverage. These plans are more budget-friendly and provide a good level of protection for common travel issues that may arise.

On the other hand, comprehensive coverage offers a wider range of benefits, including emergency medical coverage, baggage loss or delay coverage, and even coverage for business equipment. While comprehensive plans may come at a higher cost, they provide more extensive protection for business travelers facing various risks while traveling for work.

Specific Insurance Plans for Business Travelers

- Business Travel Insurance: This type of insurance is specifically designed for corporate travelers and typically includes coverage for trip cancellations, emergency medical expenses, and even coverage for business equipment and documents.

- Group Travel Insurance: Companies can opt for group travel insurance plans to cover multiple employees traveling together for business purposes. These plans often offer discounts and customized coverage options for group trips.

- Annual Multi-Trip Insurance: Ideal for frequent business travelers, annual multi-trip insurance provides coverage for multiple trips within a year, offering convenience and cost savings for those who travel regularly for work.

Factors to Consider When Choosing Trip Insurance

When selecting trip insurance as a business traveler, there are several key factors to consider to ensure you have the right coverage for your needs.

Trip Duration, Destination, and Frequency

- Consider the length of your trip: Longer trips may require more comprehensive coverage.

- Destination matters: Some locations may have higher risks, requiring specific coverage.

- Frequency of travel: If you travel frequently for business, an annual policy may be more cost-effective.

Coverage Limits, Deductibles, and Exclusions

- Pay attention to coverage limits: Make sure the policy provides enough coverage for potential expenses.

- Deductibles: Understand how much you will need to pay out of pocket before the insurance kicks in.

- Exclusions: Take note of what is not covered by the policy, such as pre-existing conditions or certain activities.

Corporate Policies and Group Coverage

Implementing trip insurance policies for employees can provide numerous benefits for corporations with frequent travelers. By offering group coverage options, businesses can protect their employees and mitigate financial risks associated with business trips.

Benefits of Group Coverage Options

- Cost Savings: Group coverage options often come at a discounted rate compared to individual policies, allowing businesses to save on overall trip insurance expenses.

- Streamlined Administration: Managing trip insurance for a group of employees is more efficient and less time-consuming than handling individual policies.

- Enhanced Coverage: Group policies can offer additional benefits and coverage options tailored to the specific needs of a company's travelers.

- Increased Security: Knowing that employees are covered by a comprehensive insurance plan can provide peace of mind for both the company and the travelers.

Examples of Successful Trip Insurance Programs

Companies like XYZ Corporation and ABC Inc. have successfully implemented trip insurance programs for their employees, reaping the benefits of group coverage options. These companies have reported higher employee satisfaction, improved risk management, and cost savings due to their comprehensive trip insurance policies.

Claims Process and Assistance for Business Travelers

When it comes to filing a trip insurance claim for business purposes, there are several steps involved to ensure a smooth process. Insurance companies also provide crucial support and assistance to travelers during emergencies, making it easier for them to navigate through unexpected situations.

Here are some tips on how business travelers can expedite the claims process for a smoother experience.

Steps to File a Trip Insurance Claim

- Notify the insurance company as soon as possible after the incident occurs.

- Provide all necessary documentation, such as receipts, medical reports, and police reports, to support your claim.

- Fill out the claim form accurately and completely to avoid any delays in processing.

- Cooperate with the insurance company's investigation if required, providing any additional information or documentation promptly.

Support and Assistance During Emergencies

- Insurance companies offer 24/7 assistance hotlines for travelers in need of immediate help.

- They can help arrange emergency medical services, transportation, and accommodations if necessary.

- Some policies may also cover trip interruptions or cancellations due to unforeseen events.

Tips to Expedite the Claims Process

- Keep all relevant documents organized and easily accessible for quick submission.

- Follow up with the insurance company regularly to check on the status of your claim.

- Be proactive in providing any additional information or documentation requested by the insurance company.

- Seek guidance from the insurance company on the proper procedures to ensure a swift resolution.

Trends and Innovations in Trip Insurance for Business Travelers

As the landscape of business travel continues to evolve, so does the trip insurance industry. Here, we will explore the latest trends and innovations in trip insurance offerings for corporate travelers.

Technological Advancements in Trip Insurance Services

Technological advancements have played a significant role in enhancing the efficiency and convenience of trip insurance services for business travelers. From streamlined online claims processing to real-time travel alerts and updates, technology has made it easier for travelers to access and manage their trip insurance coverage.

Personalized Insurance Packages for Business Travelers

Insurance providers are now offering more personalized insurance packages tailored to the specific needs of business travelers. These packages may include coverage for unique risks associated with business travel, such as coverage for lost business equipment or specialized medical coverage in international destinations.

Integration with Travel Management Platforms

Many trip insurance providers are now integrating their services with travel management platforms used by corporations to book and manage business travel. This integration allows for a seamless experience for travelers, with insurance options easily accessible during the booking process and integrated into travel itineraries.

Focus on Health and Wellness Coverage

With an increased focus on health and wellness in the workplace, trip insurance providers are expanding their coverage options to include services such as access to telemedicine, mental health support for travelers, and wellness programs aimed at promoting healthy travel habits among business travelers.

Closure

In conclusion, this discussion encapsulates the essence of Trip Insurance for Business Travelers: Corporate Coverage Options, leaving readers with a compelling summary of the key points covered throughout.

FAQ Guide

What are the key benefits of trip insurance for business travelers?

Trip insurance provides coverage for unexpected events like trip cancellations, medical emergencies, and lost luggage, offering peace of mind during corporate travel.

How do trip duration and destination impact insurance choices?

Longer trips to high-risk destinations may require more extensive coverage, while shorter domestic trips might necessitate basic insurance plans.

Can individuals purchase trip insurance for business travel, or is it typically provided by the company?

Both scenarios exist, with some companies offering coverage to employees and others leaving it up to the individual to secure trip insurance for business purposes.